Recent Blog Posts

Understanding Powers of Attorney for Health Care and Living Wills

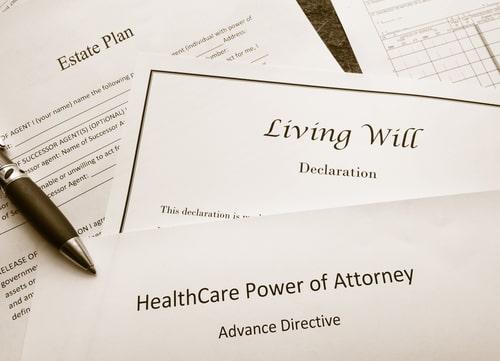

It is understandably difficult for many people to consider their own end-of-life health care decisions. They may convince themselves that they will have plenty of time to think about such things when the time comes. What if you do not have plenty of time, however? What if, for example, you are suddenly diagnosed with a fast-moving illness or terminal injuries? Being prepared is always the better option, and a power of attorney for health care and a living will can help you stay ahead of life’s unpredictability.

It is understandably difficult for many people to consider their own end-of-life health care decisions. They may convince themselves that they will have plenty of time to think about such things when the time comes. What if you do not have plenty of time, however? What if, for example, you are suddenly diagnosed with a fast-moving illness or terminal injuries? Being prepared is always the better option, and a power of attorney for health care and a living will can help you stay ahead of life’s unpredictability.

What is a Power of Attorney for Health Care?

While a living will and power of attorney for health care can be used in conjunction with each other, it is important to understand the basic differences between the two. A power of attorney for health care grants an individual or entity of your choosing-known as an agent-the authority to make medical and health-related decisions on your behalf should you become unable to do so. This typically applies to situations of mental or physical incapacitation. The power of attorney may include specific directions for the agent regarding your wishes, and any health-related concern you have not specifically addressed will be decided at the discretion of your appointed agent.

What Should I Include in an Illinois Pet Trust?

More than half of all Illinois households include at least one family pet. Of course, in many homes, a companion animal like a dog or cat is much more than a pet; they are a part of the family, with their own personality, temperament, and individuality. But, have you considered what will happen to your beloved animal friend in the event that you are no longer able to care for them? Through the estate planning process, you have probably begun to address your home, car, and the guardianship or care of your children. However, it is also important to plan for the ongoing care of pets. Fortunately, there is a tool known as a pet trust, that when used properly can offer you the peace of mind that comes with knowing your dog or cat will be well cared for, even if you cannot provide the care.

More than half of all Illinois households include at least one family pet. Of course, in many homes, a companion animal like a dog or cat is much more than a pet; they are a part of the family, with their own personality, temperament, and individuality. But, have you considered what will happen to your beloved animal friend in the event that you are no longer able to care for them? Through the estate planning process, you have probably begun to address your home, car, and the guardianship or care of your children. However, it is also important to plan for the ongoing care of pets. Fortunately, there is a tool known as a pet trust, that when used properly can offer you the peace of mind that comes with knowing your dog or cat will be well cared for, even if you cannot provide the care.

Why Not a Will?

According to the law, pets-even domestic animals-are considered property. However, in various applications, including divorce, courts have begun recognizing that there are some special considerations that must be made. While pets are not quite human, they are certainly different from property like furniture or artwork. For the purposes of estate planning, the Illinois legislature has created the ability for a pet owner to establish and fund a pet trust to provide for the care of companion animals after the owner’s death. As property, pets can also be included in an owner’s will, but given that a will has to go through the often time-consuming and messy process of probate, a trust allows the animal to be settled into its new home and environment much faster with less hassle.

What Are the Laws Regarding Gestational and Traditional Surrogacy?

Surrogacy can allow an individual or couple to fulfill their dreams of becoming a parent. However, surrogacy is also a complicated process – legally, emotionally, and financially. If you want to use a surrogate to have a child, it is essential that you learn about surrogacy laws in Illinois and work with an experienced family law attorney. Your lawyer can protect your rights and the rights of your unborn child, draft a comprehensive surrogacy contract, and ensure that your surrogacy plan meets the requirements set forth by Illinois law.

Understanding the Illinois Gestational Surrogacy Act

The Illinois Gestational Surrogacy Act (IGSA) establishes the requirements for a valid gestational surrogacy contract. If parents follow these requirements, the parents will be automatically named on the child’s birth certificate and will not need to take additional legal action to gain parental rights for their new baby. In a gestational surrogacy, the surrogate is not biologically related to the child. The egg and sperm are combined using in vitro fertilization and then the embryo is implanted in the surrogate’s uterus. The IGSA sets forth many requirements, including:

Is a Parenting Marriage a Viable Alternative to Divorce?

There used to be just two options for married couples: Stay together or get divorced. Now there are conscious uncouplers, bird-nesters, and even those who turn their traditional marriage into a "parenting marriage." This last non-traditional family unit-the parenting marriage-is gaining a lot of traction lately, particularly among those who are at a deadlock in their marriage but still want to see their children every day. Could this model realistically work for your family as an alternative to divorce?

What Is a Parenting Marriage?

In many ways, a parenting marriage is a lot like a traditional marriage. The couple is (usually) still legally married, and they continue to live in the same house. However, their marriage is no longer an intimate relationship. Instead, it is a platonic one. They do not share the same bed, there is little to no physical intimacy, and most have separate finances and accounts. The sole function of their marriage is to raise their children together under the same roof without the stress of trying to mend a relationship that is no longer working.

Comprehensive Estate Planning Can Prevent Family Disputes

If you were to ask your children or other family members what you should do about dividing your assets and property upon your death, you would likely get a variety of answers. Some may suggest that you just divide it equally-without offering ways to determine what “equal” means. Others may remind you that you can make any arrangements that you want since it is your property. Of course, chances are also good that the same family members telling you to do whatever you think is best could be the same ones who are offended when they discover that their inheritance is not what they expected it would be. Fortunately, a qualified estate planning lawyer can offer a great deal of insight into planning for the future and, based on previous experience, can even provide advice on how to prepare your family for what is ahead.

Determine Your Priorities

Those who remind you that you have the right to do with your estate what you wish are exactly correct. You certainly have that right. However, it is important to consider how dividing your assets could affect your family and loved ones over the long term. You may decide that you do not really care if family members are upset or offended by your choices since you will be gone, and that too is your right. For many people, the specific property and assets that each heir receives are far less important than maintaining stable, trusting family relationships. Although it is not true in every situation, you may have the power with your estate planning decisions to positively or negatively affect your surviving family. Use it wisely.

Study Suggests it Can Take Years to Financially Recover from Divorce

Ending a marriage is a difficult endeavor with many possible financial pitfalls from which a person may spend years trying to recover. In fact, one study suggests that it may take as long as five years to overcome the financial impact of a divorce. In some cases it may take even longer, possibly decades. However, there are ways to minimize the financial risks of divorce, especially if you are well prepared and you have the guidance of a qualified divorce attorney.

Ending a marriage is a difficult endeavor with many possible financial pitfalls from which a person may spend years trying to recover. In fact, one study suggests that it may take as long as five years to overcome the financial impact of a divorce. In some cases it may take even longer, possibly decades. However, there are ways to minimize the financial risks of divorce, especially if you are well prepared and you have the guidance of a qualified divorce attorney.

The Intersection of Divorce and Debt

Most Americans have debt. Some fail to manage it responsibly, but others are diligent about only taking on obligations they can afford. However, both groups are at risk of financial difficulties after a divorce. This is due, in part, to the splitting of one household into two. Each party must now cover their own separate bills, housing expenses, and utilities. They must also be able to pay the share of the marital debt that was allocated to them, which can be difficult to manage on a single income. The more debt a couple has going into the divorce, the higher their risk typically is.

What Is Required to Obtain an Order of Protection in Illinois?

Domestic violence affects the lives of millions of individuals in Illinois and across the country. If you, your child, or a disabled adult who you know have been abused or harassed, you may be interested in getting an order of protection. Called restraining orders in other states, an Illinois order of protection is a legal court order that prohibits someone from further harassment and abuse. It may require the abuser, called the respondent, from coming to your home, workplace, or school or contacting you. It may even require the respondent to move out of your shared home or surrender any firearms he or she owns.

Emergency Orders of Protection May Be Granted Based on Your Testimony

In Illinois, there are three main types of protection orders: emergency orders of protection, interim orders of protection, and plenary orders of protection. Emergency orders of protection (EOP) are often issued on the same day that they are requested. In most legal actions, the respondent must be served with notice of the action. However, an EOP may be granted "per se," which means that the respondent is not present or notified of the court order. The EOP may be granted on your testimony alone.

Basic But Essential Estate Planning Steps in Illinois

Estate planning can be a complex matter, with state and federal laws to consider, but the initial steps do not have to be complicated. In fact, almost anyone can complete an effective estate plan with the right mindset and good advice from an experienced estate planning attorney. While some estates are more complicated than others, there are basic concepts that apply to virtually every situation.

Estate planning can be a complex matter, with state and federal laws to consider, but the initial steps do not have to be complicated. In fact, almost anyone can complete an effective estate plan with the right mindset and good advice from an experienced estate planning attorney. While some estates are more complicated than others, there are basic concepts that apply to virtually every situation.

Know Your Assets

From your real estate property, to the remainder of your retirement plan, to your beloved baseball card collection, it is crucial that you know what you own before you start the estate planning process. Start by gathering detailed documents for all of your financial accounts, including bank accounts, savings bonds, and retirement accounts, as well as your real estate, vehicles, and other large assets. Then make a list of family heirlooms and property that may have value. If necessary, have items appraised so that you know how much you are leaving to each of your heirs.

Mitigating the Risk of Heart Disease or Stroke Linked to Divorce

When it comes to health complications, divorcees have the odds stacked against them. In fact, studies have linked divorce to everything from weight gain and depression to an increased risk of experiencing a heart attack. Granted, an increased risk does not mean you will experience a stroke, nor does it mean you should avoid divorce if it truly feels like the right path for your life. However, it does suggest that divorcees should know how to protect their health and mitigate against the risks.

Examining the Possible Link

Nearly anyone who has endured divorce can tell you it is an emotionally, mentally, and sometimes even physically trying experience. Thankfully, the stress usually diminishes over time, but the damage could already be done by the time things calm down. In fact, experts now believe that stress may be the driving factor behind all links to potential heart conditions. It certainly makes sense when you consider what stress does to the body.

What Happens During the Illinois Probate Process?

When an Illinois resident dies, his or her estate will often need to go through the process of probate. In Illinois, probate is required to validate and administer the decedent’s will, or to determine that the decedent did not have a valid will in place. Depending on the circumstances, probate can be a long and daunting process, and it may be a source of stress when there are arguments about the estate, but understanding the process can go a long way in helping you through it.

When an Illinois resident dies, his or her estate will often need to go through the process of probate. In Illinois, probate is required to validate and administer the decedent’s will, or to determine that the decedent did not have a valid will in place. Depending on the circumstances, probate can be a long and daunting process, and it may be a source of stress when there are arguments about the estate, but understanding the process can go a long way in helping you through it.

The Role of the Executor or Estate Administrator

During the probate process, an estate executor or administrator manages the assets and debts of the deceased. If there is a valid will, it will usually name the person who will serve as executor. In the absence of a will, the court will appoint an administrator, which will often be the closest surviving family member. Named executors can decline their duties if they are unwilling or unable to fulfill them.